Track Record

HH&L Acquisition Co. (NYSE: HHLA, size: US$414m)

- HH&L is one of the largest and most successful healthcare-focused SPACs in Asia. The SPAC received investment orders more than 10 times the offering size from the world’s largest funds and successfully listed on the New York Stock Exchange in February 2021.

Chenghe Acquisition Co. (Nasdaq: CHEAU, size: US$115m)

- Chenghe Acquisition Co. received investment orders more than four times the offering size from top notch investors and successfully listed on Nasdaq in April 2022. Chenghe Acquisition Co. completed its merger with Taiwan Color Optics, Inc. in February 2024.

Chenghe Acquisition I Co. (Nasdaq: LATG, size: US$130m)

- The Chenghe team took over the former LatAm Growth SPAC in October 2023, marking the first successful acquisition of a US public SPAC by an Asian sponsor. Chenghe Acquisition I Co. signed a business combination agreement with FEMCO Steel Technology Co., Ltd. in December 2023.

Chenghe Acquisition II Co. (NYSE: CHEB, size: US$86.25m)

- Chenghe Acquisition II Co. was multiple times oversubscribed and successfully listed on the New York Stock Exchange in June 2024. The SPAC signed a business combination agreement with Polibeli Group Ltd. in September 2024.

Chenghe’s key members and partners have been involved in the IPOs of or early-stage investments in prominent companies including WuXi Biologics, Meituan, Pinduoduo, Xiaomi, WeDoctor, China Renaissance Capital, Guotai Junan and Shenwan Hongyuan, among others.

Additionally, Chenghe is a partner of Wealthking Investment (HKEx:1140), the co-founder of CSOP Asset Management Limited, one of the largest asset managers in Hong Kong

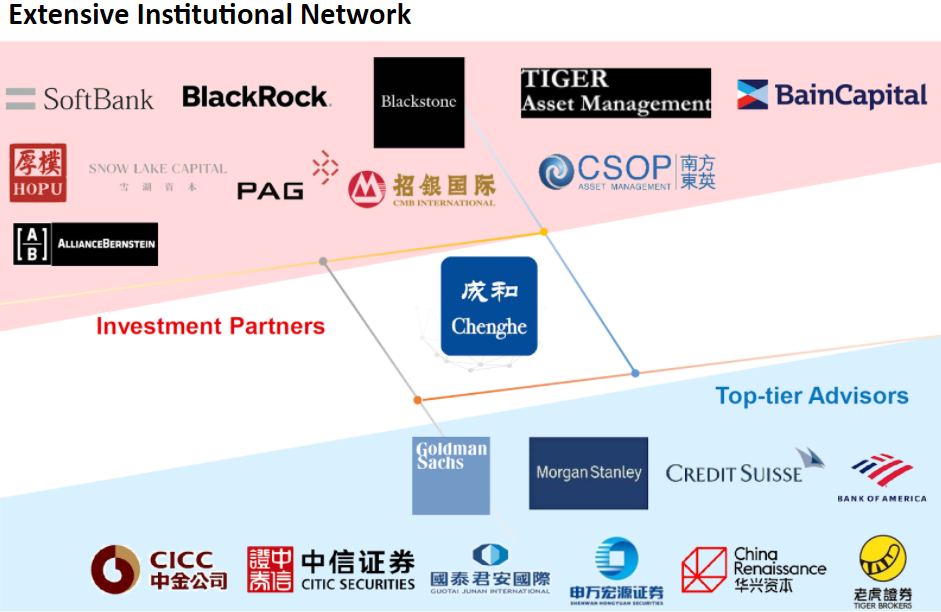

Institutional Partners